Property Insurance

Table of Contents

Property Insurance: A Comprehensive Guide:

Property insurance is a type of insurance coverage that provides financial protection to individuals or businesses against losses or damage to their property. This insurance is designed to safeguard assets such as homes, buildings, and other structures, as well as their contents, from unforeseen events like theft, fire, natural disasters, and more. For both homeowners and business owners, property insurance plays a critical role in managing risk and ensuring financial stability.

Types of Property Insurance:

Term Life Insurance, There are various types of property insurance policies available, each tailored to cover specific kinds of properties and risks. The most common types include:

Homeowners Insurance

Homeowners insurance is possibly the greatest extensively documented shape of property insurance. It covers damage or loss to a private residence and its contents due to events such as fire, theft, or natural disasters. Additionally, it often includes liability coverage in case someone is injured on the property.

Renters Insurance

This policy is designed for tenants who live in rental properties. While the landlord’s insurance typically covers the physical structure, renters insurance covers the tenant’s personal belongings inside the rented space. It also offers liability protection if someone is injured in the rented unit.

Commercial Property Insurance

This type of insurance is essential for businesses. It protects commercial buildings, inventory, equipment, and other assets from damage or loss due to events such as fire, storms, vandalism, or theft. Business owners can also opt for business interruption coverage, which compensates for lost income during the time the business is unable to operate due to property damage.

Condo Insurance

Condo insurance is similar to homeowners insurance but personalized exactly for condominium owners. It usually covers personal property, interior repairs, and liability. However, the structure itself is often insured through the condo association’s master policy.

Coverage Provided by Property Insurance:

The coverage provided by property insurance varies depending on the policy and insurer. However, most property insurance policies typically include:

Dwelling Coverage

This covers the physical structure of the home or building, protecting it from damages due to covered perils such as fire, hail, windstorms, or vandalism. It also covers attached structures like garages or decks.

Personal Property Coverage

This aspect of property insurance covers the owner’s belongings, such as furniture, electronics, clothing, and appliances, in the event of damage or theft. Some policies also offer coverage for personal property outside the home, like a stolen laptop.

Liability Protection

If someone is injured on the insured property and sues the owner for medical expenses or damages, liability coverage can help cover legal fees and settlements. This protection extends to incidents of property damage caused to others as well.

Loss of Use Coverage

If the insured property is damaged and becomes uninhabitable or unusable due to a covered peril, loss of use coverage provides compensation for additional living expenses, such as hotel stays and meals, until the property is repaired.

Additional Structures Coverage

In addition to the primary dwelling, many policies include coverage for detached structures on the property, such as sheds, fences, or guest houses.

Common Exclusions in this Insurance:

While property insurance offers broad coverage, certain exclusions are standard in most policies. These exclusions include:

Flood Damage

Most property insurance strategies do not shelter harm produced by deluges. Homeowners or businesses in flood-prone areas may need to purchase separate flood insurance through programs like the National Flood Insurance Program (NFIP).

Earthquake Damage

Similar to floods, damage caused by earthquakes is often excluded from standard property insurance policies. Individuals in high-risk areas can buy separate earthquake insurance to cover potential damages.

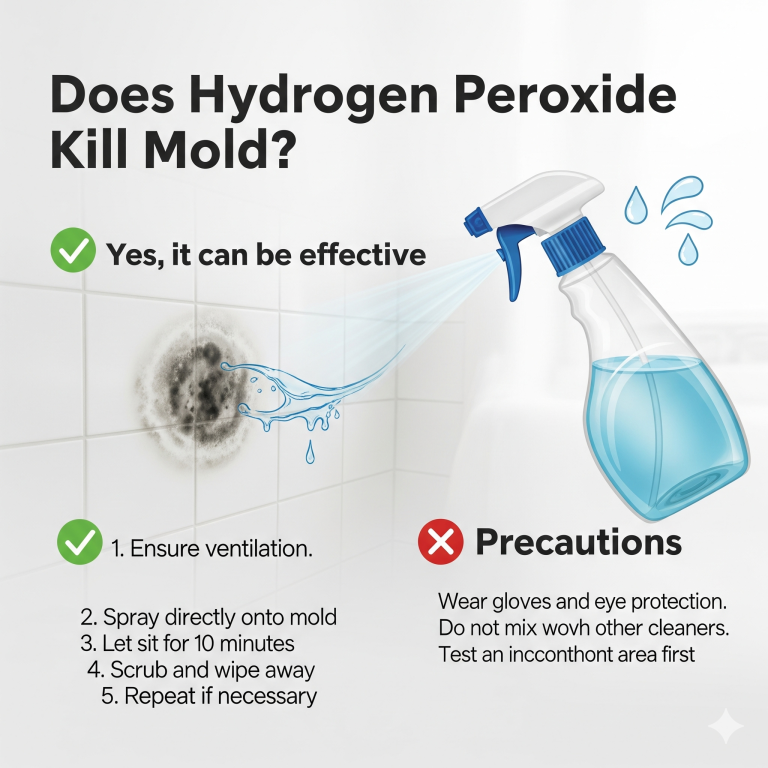

Maintenance-Related Issues

This insurance typically covers sudden and accidental damage, but it does not cover issues that result from poor maintenance, such as mold, pest infestations, or gradual wear and tear.

Acts of War or Terrorism

Many policies do not count harms influenced by actions of battle or terrorism. However specialized insurance can be purchased in some countries in some countries to cover these risks.

Conclusion:

Property insurance is an important tool for handling the financial dangers linked with property possession. Whether it’s a home, rental, or commercial property, having the right coverage can protect against significant losses and provide peace of mind in unexpected disasters. By carefully assessing coverage needs, comparing policies, and understanding exclusions, property owners can make informed decisions to safeguard their investments.